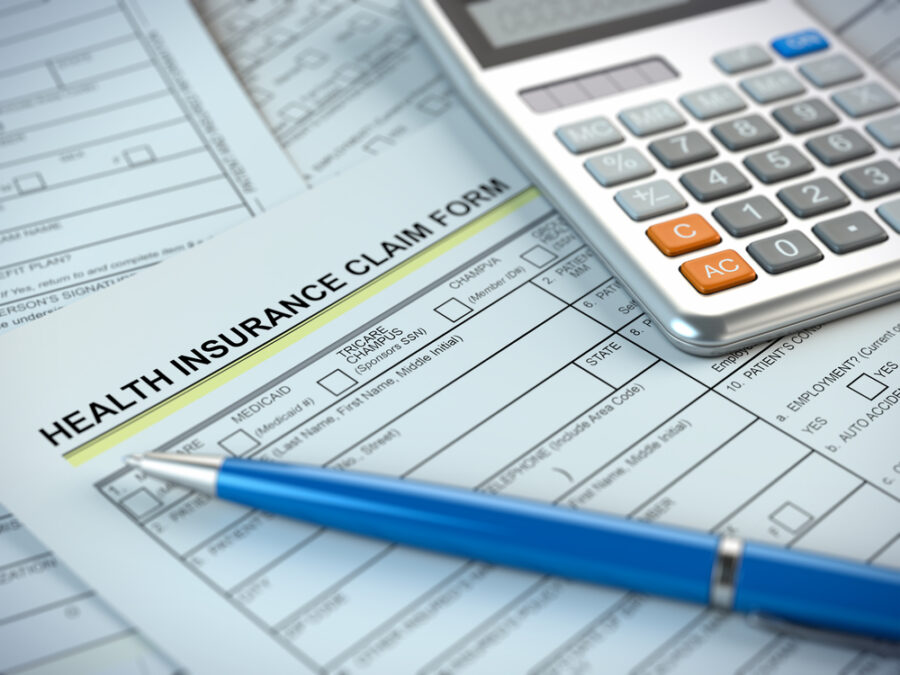

Over the years, health insurance has grown to become a necessity in everyone’s life. Healthcare is very expensive. The ever-rising healthcare can disrupt a family’s financial stability, especially if a member is seriously ill. For this reason, it becomes essential to find the right health insurance so that one can enjoy quality treatment without exhausting savings.

There are numerous online health insurance providers, including reputable ones such as US Health Group. Such healthcare insurance providers have excellent plans tailored toward meeting the needs of their clients. For instance, the insurance provider has different insurance packages, such as dental coverage and optical insurance. This article will explore and help people understand what online health insurance is the different packages, and their composition.

What is Online Health Insurance?

Online health insurance is a contract between an insured person and the insurance company. The company offers financial coverage to cover medical expenses that may arise from the insured being injured or ill. Online health insurance comes in handy in helping people protect themselves as well as their families from medical costs that may come up from such incidents. The insurance covers critical aspects such as accidents, sickness, surgeries, and much more.

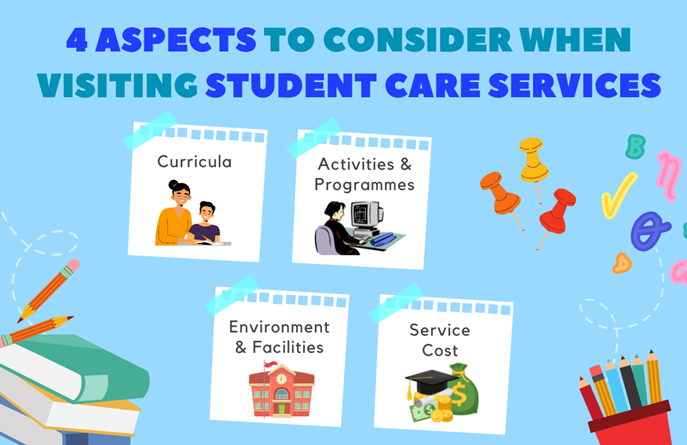

Customizable Packages

Online health insurance offers clients an array of choices to select from that match their budgets and needs. Every person has personalized healthcare needs; therefore, insurance companies strive to offer customizable options. So no matter what one’s healthcare needs are, an insurance company can work with the insured to provide the best health coverage.

The Primary Insurance Packages

As mentioned above, there are different kinds of insurance coverage when it comes to personalized client needs. Insurance companies offer reliable and flexible coverage plans for one’s health needs. Below are some of the popular insurance packages people can opt for when they approach a reputable insurance company.

General Health Coverage

General health insurance coverage is a go-to package to get covered for general health issues. It is one of the most preferred coverages for personal as well as family use. This package comes with several benefits.

Firstly, one can access any doctor from any hospital. This is a huge deal for most clients who have different illnesses. People can visit a specialist of their choice at any office. This allows them to access the best medical care for their treatment.

Secondly, one enjoys all-day-long coverage, on or off the job. People can access healthcare any time of the day at a hospital of their preference. This is critical, especially if a person experiences a medical emergency that often requires immediate intervention from medical personnel.

Thirdly, insured people can enjoy quality coverage when they are critically ill. When they visit any hospital, their insurance coverage will allow them to receive top-tier medical attention, receive original medicine, and undergo all relevant medical tests.

Finally, those insured can benefit from health and wellness screening services. People do not have to wait to get sick to visit the hospital. The insurance coverage allows the insured to monitor their vitals, such as blood pressure, sugar levels, and cancer screening, among others.

Dental Health Coverage

Great oral care habits are not only tied to one’s teeth – a healthy mouth results in a healthy body. For this reason, regularly visiting a dentist is more than necessary. Dental health coverage provides people with the required healthcare coverage for oral health. The insurance covers most procedures aimed at promoting one’s oral hygiene. There are tons of benefits that come with getting this insurance package.

Firstly, there are about three primary dental plans that people can choose from. These plans are customized according to a client’s needs. The insurance is equipped to cover clients, whether they need regular mouth cleaning, a minor procedure, or surgical procedures such as tooth extractions.

Secondly, clients get to enjoy preventive dental care coverage. Under this package, patients can receive quality oral preventive care. Such treatments include general teeth cleaning. Additionally, insurance coverage allows one to visit any hospital to receive these services.

Thirdly, those covered can access basic dental care coverage packages. This package focuses on basic dental care, such as general consultation and treatment of less-severe ailments.

Fourthly, patients can also enjoy primary dental care services. This insurance covers more severe dental cases, such as dental surgeries. People may never know when such emergency cases might arise; therefore, having dental health coverage is vital.

Vision Health Coverage

Vision is an important aspect of most people’s lives. No one would wish to lose their eyesight, especially if the cause is preventable. Therefore, it becomes necessary to secure vision health coverage to ensure one’s eyes are covered and one can receive treatment at no extra cost when needed. Here are some of the benefits clients can enjoy under vision health coverage.

Firstly, one gets comprehensive eye exam coverage. An eye examination is a delicate procedure that requires sophisticated equipment and high-level expertise. These can mainly be performed and covered by one’s vision insurance. Then, patients can visit a major hospital of their choice to receive an eye examination.

Secondly, clients are covered under the corrective lens coverage. Over time, lenses lose their effectiveness. They need to be assessed against a patient to understand if they need to be corrected. These procedures are critical and are all covered under one’s vision health coverage.

Thirdly, patients are subjected to receive an annual allowance towards frames. Clients who use prescribed glasses often find it comfortable to change frames from time to time. However, frames can be quite expensive, especially if the client’s preference lies among the classy ones. The easiest way to afford these frames is by using one’s vision insurance coverage.

Conclusion

Online health insurance has grown to be a necessity in this era. Many people are taking up the idea of protecting themselves and their families against illnesses. People often opt for dental, vision, and general insurance coverage according to their needs and preferences. Not only do they save costs when they visit the hospital, but they also enjoy a wide range of medical benefits associated with the coverage.